ISLR实验:分类 - 逻辑斯谛回归

本文源自《统计学习导论:基于R语言应用》(ISLR) 中《4.6 R实验:逻辑斯谛回归、LDA、QDA和KNN》章节

library(ISLR)

library(corrgram)

library(car)

library(pROC)

数据

股票市场数据

attach(Smarket)

head(Smarket)

Year Lag1 Lag2 Lag3 Lag4 Lag5 Volume Today Direction

1 2001 0.381 -0.192 -2.624 -1.055 5.010 1.1913 0.959 Up

2 2001 0.959 0.381 -0.192 -2.624 -1.055 1.2965 1.032 Up

3 2001 1.032 0.959 0.381 -0.192 -2.624 1.4112 -0.623 Down

4 2001 -0.623 1.032 0.959 0.381 -0.192 1.2760 0.614 Up

5 2001 0.614 -0.623 1.032 0.959 0.381 1.2057 0.213 Up

6 2001 0.213 0.614 -0.623 1.032 0.959 1.3491 1.392 Up

dim(Smarket)

[1] 1250 9

summary(Smarket)

Year Lag1 Lag2

Min. :2001 Min. :-4.922000 Min. :-4.922000

1st Qu.:2002 1st Qu.:-0.639500 1st Qu.:-0.639500

Median :2003 Median : 0.039000 Median : 0.039000

Mean :2003 Mean : 0.003834 Mean : 0.003919

3rd Qu.:2004 3rd Qu.: 0.596750 3rd Qu.: 0.596750

Max. :2005 Max. : 5.733000 Max. : 5.733000

Lag3 Lag4 Lag5

Min. :-4.922000 Min. :-4.922000 Min. :-4.92200

1st Qu.:-0.640000 1st Qu.:-0.640000 1st Qu.:-0.64000

Median : 0.038500 Median : 0.038500 Median : 0.03850

Mean : 0.001716 Mean : 0.001636 Mean : 0.00561

3rd Qu.: 0.596750 3rd Qu.: 0.596750 3rd Qu.: 0.59700

Max. : 5.733000 Max. : 5.733000 Max. : 5.73300

Volume Today Direction

Min. :0.3561 Min. :-4.922000 Down:602

1st Qu.:1.2574 1st Qu.:-0.639500 Up :648

Median :1.4229 Median : 0.038500

Mean :1.4783 Mean : 0.003138

3rd Qu.:1.6417 3rd Qu.: 0.596750

Max. :3.1525 Max. : 5.733000

探索数据

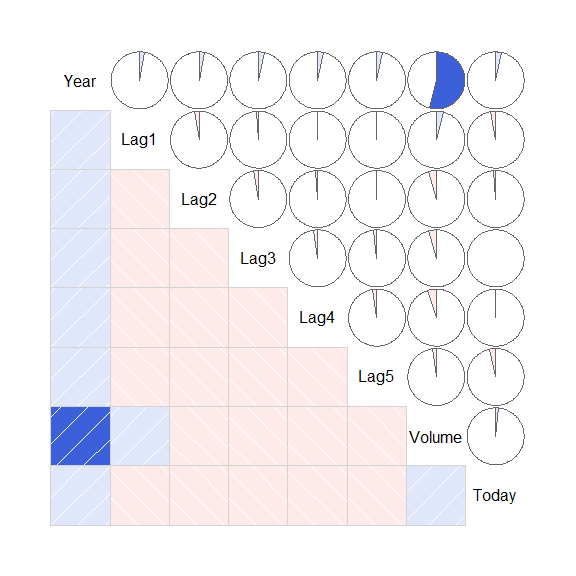

相关性

cor() 函数计算相关系数矩阵

注:因子变量 Direction 无法计算相关性

cor(Smarket[, -9])

Year Lag1 Lag2 Lag3 Lag4 Lag5

Year 1.00000000 0.029699649 0.030596422 0.033194581 0.035688718 0.029787995

Lag1 0.02969965 1.000000000 -0.026294328 -0.010803402 -0.002985911 -0.005674606

Lag2 0.03059642 -0.026294328 1.000000000 -0.025896670 -0.010853533 -0.003557949

Lag3 0.03319458 -0.010803402 -0.025896670 1.000000000 -0.024051036 -0.018808338

Lag4 0.03568872 -0.002985911 -0.010853533 -0.024051036 1.000000000 -0.027083641

Lag5 0.02978799 -0.005674606 -0.003557949 -0.018808338 -0.027083641 1.000000000

Volume 0.53900647 0.040909908 -0.043383215 -0.041823686 -0.048414246 -0.022002315

Today 0.03009523 -0.026155045 -0.010250033 -0.002447647 -0.006899527 -0.034860083

Volume Today

Year 0.53900647 0.030095229

Lag1 0.04090991 -0.026155045

Lag2 -0.04338321 -0.010250033

Lag3 -0.04182369 -0.002447647

Lag4 -0.04841425 -0.006899527

Lag5 -0.02200231 -0.034860083

Volume 1.00000000 0.014591823

Today 0.01459182 1.000000000

corrgram 包的 corrgram() 函数绘制相关图

corrgram(

Smarket[, -9],

lower.panel=panel.shade,

upper.panel=panel.pie,

text.panel=panel.txt

)

前几日投资回报率 (Lag1 - Loag5) 与当日回报率 (Today) 之间的相关系数接近于 0。

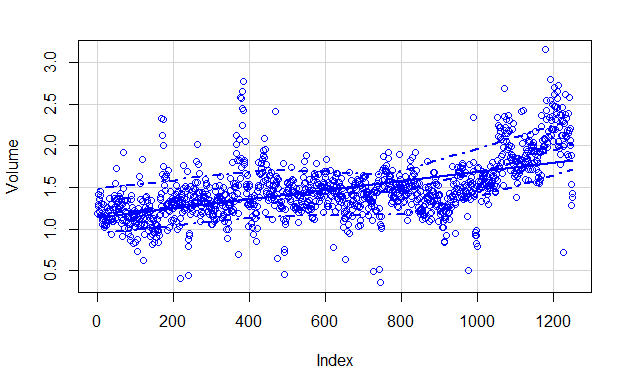

唯一有较大相关性的是 Year 与 Volume,因为 Volume 随 Year 增加而增长

scatterplot(

1:length(Volume),

Volume,

xlab="Index",

ylab="Volume",

boxplots=FALSE

)

模型

glm() 函数用于拟合 广义线性模型 (generalized linear model)

family=binomial 使用逻辑斯谛回归

glm_fit <- glm(

Direction ~ Lag1 + Lag2 + Lag3 + Lag4 + Lag5 + Volume,

data=Smarket,

family=binomial

)

summary(glm_fit)

Call:

glm(formula = Direction ~ Lag1 + Lag2 + Lag3 + Lag4 + Lag5 +

Volume, family = binomial, data = Smarket)

Deviance Residuals:

Min 1Q Median 3Q Max

-1.446 -1.203 1.065 1.145 1.326

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -0.126000 0.240736 -0.523 0.601

Lag1 -0.073074 0.050167 -1.457 0.145

Lag2 -0.042301 0.050086 -0.845 0.398

Lag3 0.011085 0.049939 0.222 0.824

Lag4 0.009359 0.049974 0.187 0.851

Lag5 0.010313 0.049511 0.208 0.835

Volume 0.135441 0.158360 0.855 0.392

(Dispersion parameter for binomial family taken to be 1)

Null deviance: 1731.2 on 1249 degrees of freedom

Residual deviance: 1727.6 on 1243 degrees of freedom

AIC: 1741.6

Number of Fisher Scoring iterations: 3

p 值均比较大,说明没有充分证据表明预测变量与 Direction 之间有确切的关联

系数

coef() 函数获取系数

coef(glm_fit)

(Intercept) Lag1 Lag2 Lag3 Lag4

-0.126000257 -0.073073746 -0.042301344 0.011085108 0.009358938

Lag5 Volume

0.010313068 0.135440659

summary() 的结果可以获取更详细的信息,包括系数的 p 值

summary(glm_fit)$coef

Estimate Std. Error z value Pr(>|z|)

(Intercept) -0.126000257 0.24073574 -0.5233966 0.6006983

Lag1 -0.073073746 0.05016739 -1.4565986 0.1452272

Lag2 -0.042301344 0.05008605 -0.8445733 0.3983491

Lag3 0.011085108 0.04993854 0.2219750 0.8243333

Lag4 0.009358938 0.04997413 0.1872757 0.8514445

Lag5 0.010313068 0.04951146 0.2082966 0.8349974

Volume 0.135440659 0.15835970 0.8552723 0.3924004

summary(glm_fit)$coef[,4]

(Intercept) Lag1 Lag2 Lag3 Lag4

0.6006983 0.1452272 0.3983491 0.8243333 0.8514445

Lag5 Volume

0.8349974 0.3924004

预测

predict() 函数用于预测

type="response" 表示输出概率 P(Y=1 | X)

glm_probs <- predict(

glm_fit,

type="response"

)

glm_probs[1:10]

1 2 3 4 5 6

0.5070841 0.4814679 0.4811388 0.5152224 0.5107812 0.5069565

7 8 9 10

0.4926509 0.5092292 0.5176135 0.4888378

1 表示 Up,即上涨

contrasts(Direction)

Up

Down 0

Up 1

将概率转换为类别

glm_predict <- rep("Down", 1250)

glm_predict[glm_probs > 0.5] = "Up"

table() 函数生成混淆矩阵,列联表

| 预测- | 预测+ | ||

|---|---|---|---|

| 真实- | 真阴性值 TN | 假阳性值 FP | N |

| 真实+ | 假阳性值 FN | 真阳性值 TP | P |

| N* | P* |

glm_predict_table <- table(

glm_predict,

Direction

)

glm_predict_table

Direction

glm_predict Down Up

Down 145 141

Up 457 507

addmargins(glm_predict_table)

Direction

glm_predict Down Up Sum

Down 145 141 286

Up 457 507 964

Sum 602 648 1250

计算正确率

(TF + TP) / (F + P)

(507+145) / 1250

[1] 0.5216

mean(glm_predict == Direction)

[1] 0.5216

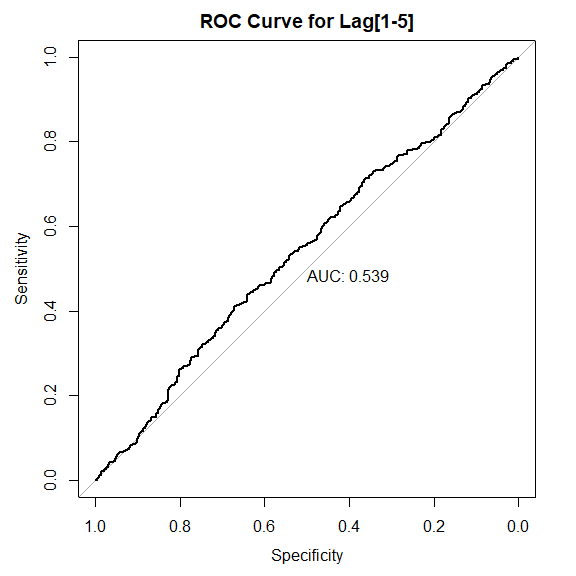

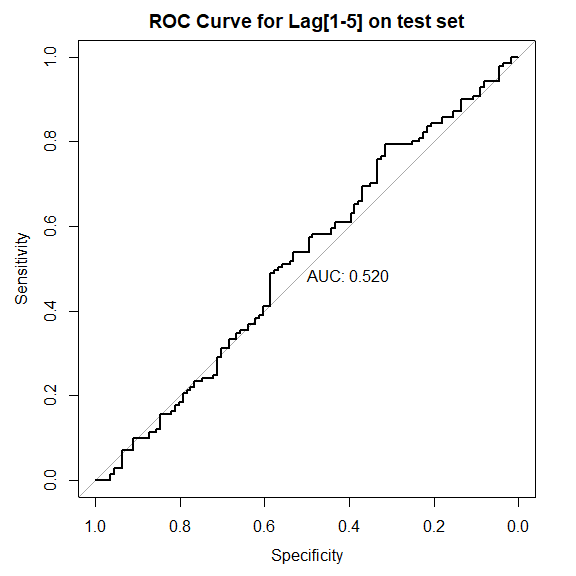

ROC 曲线

pROC 包的 roc() 函数

plot(

roc(

Direction,

glm_probs

),

print.auc=TRUE,

plot=TRUE,

main="ROC Curve for Lag[1-5]"

)

AUC 值很接近 0.5,与随机猜想效果差不多。

训练集与测试集

训练集:2001 至 2004 年

测试集:2005 年

train <- (Year < 2005)

train 是一个布尔变量,Boolean vector

smarket_2005 <- Smarket[!train, ]

dim(smarket_2005)

[1] 252 9

direction_2005 <- Direction[!train]

使用 subset 参数拟合子集

glm_train_fit <- glm(

Direction ~ Lag1 + Lag2 + Lag3 + Lag4 + Lag5 + Volume,

data=Smarket,

subset=train,

family=binomial

)

summary(glm_train_fit)

Call:

glm(formula = Direction ~ Lag1 + Lag2 + Lag3 + Lag4 + Lag5 +

Volume, family = binomial, data = Smarket, subset = train)

Deviance Residuals:

Min 1Q Median 3Q Max

-1.302 -1.190 1.079 1.160 1.350

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) 0.191213 0.333690 0.573 0.567

Lag1 -0.054178 0.051785 -1.046 0.295

Lag2 -0.045805 0.051797 -0.884 0.377

Lag3 0.007200 0.051644 0.139 0.889

Lag4 0.006441 0.051706 0.125 0.901

Lag5 -0.004223 0.051138 -0.083 0.934

Volume -0.116257 0.239618 -0.485 0.628

(Dispersion parameter for binomial family taken to be 1)

Null deviance: 1383.3 on 997 degrees of freedom

Residual deviance: 1381.1 on 991 degrees of freedom

AIC: 1395.1

Number of Fisher Scoring iterations: 3

预测 2005 年数据

glm_2005_probs <- predict(

glm_train_fit,

smarket_2005,

type="response"

)

使用 50% 作为阈值

glm_2005_predict <- rep("Down", 252)

glm_2005_predict[glm_2005_probs > .5] = "Up"

table(glm_2005_predict, direction_2005)

direction_2005

glm_2005_predict Down Up

Down 77 97

Up 34 44

mean(glm_2005_predict == direction_2005)

[1] 0.4801587

mean(glm_2005_predict != direction_2005)

[1] 0.5198413

比随机猜想更糟糕!

ROC 曲线

plot(

roc(

direction_2005,

glm_2005_probs

),

print.auc=TRUE,

plot=TRUE,

main="ROC Curve for Lag[1-5] on test set"

)

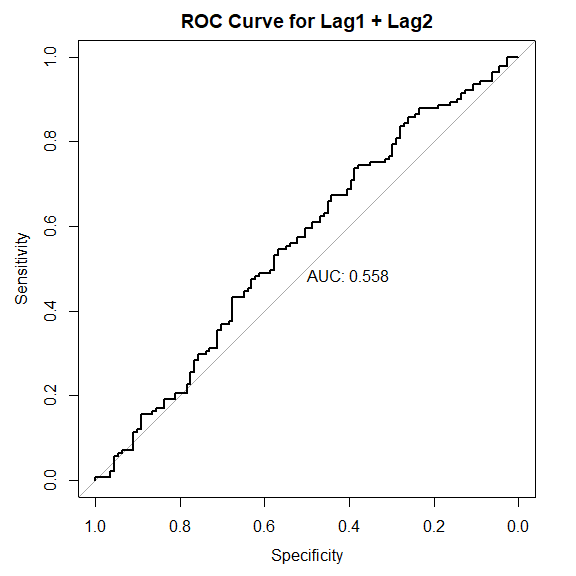

使用更少的变量

仅使用 Lag1 和 Lag2

glm_train_fit_v2 <- glm(

Direction ~ Lag1 + Lag2,

data=Smarket,

subset=train,

family=binomial

)

summary(glm_train_fit_v2)

Call:

glm(formula = Direction ~ Lag1 + Lag2, family = binomial, data = Smarket,

subset = train)

Deviance Residuals:

Min 1Q Median 3Q Max

-1.345 -1.188 1.074 1.164 1.326

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) 0.03222 0.06338 0.508 0.611

Lag1 -0.05562 0.05171 -1.076 0.282

Lag2 -0.04449 0.05166 -0.861 0.389

(Dispersion parameter for binomial family taken to be 1)

Null deviance: 1383.3 on 997 degrees of freedom

Residual deviance: 1381.4 on 995 degrees of freedom

AIC: 1387.4

Number of Fisher Scoring iterations: 3

测试集性能

glm_2005_probs_v2 <- predict(

glm_train_fit_v2,

smarket_2005,

type="response"

)

glm_2005_predict_v2 <- rep("Down", 252)

glm_2005_predict_v2[glm_2005_predict_v2 > .5] = "Up"

table(glm_2005_predict_v2, direction_2005)

direction_2005

glm_2005_predict_v2 Down Up

Up 111 141

mean(glm_2005_predict_v2 == direction_2005)

[1] 0.5595238

准确率

mean(glm_2005_predict_v2 != direction_2005)

[1] 0.4404762

预测阳性率

106/(106+76)

[1] 0.5824176

ROC 曲线

plot(

roc(

direction_2005,

glm_2005_probs_v2

),

print.auc=TRUE,

plot=TRUE,

main="ROC Curve for Lag1 + Lag2"

)

预测效果略有改善,但仍和随机猜想效果差不多。

参考

https://github.com/perillaroc/islr-study

ISLR实验系列文章

线性回归

分类

重抽样方法

线性模型选择与正则化